Benefits of Paying Extra on Your Personal Loan Each Month

01 JULY 2024

Paying extra towards your personal loan each month can have significant financial advantages, potentially saving you money on interest and allowing you to pay off your loan faster. When taking a personal loan, the first step is to ensure that you select an option that is best suited to your budget, and allows you a little breathing room in regard to the monthly repayment.  When doing this, you allow yourself the opportunity to pay slightly more than what you contractually have to, and below we will look at why this could be a game changer for you. It is important to note, however, that whether you are permitted to “overpay” depends on your individual agreement with the lender.

When doing this, you allow yourself the opportunity to pay slightly more than what you contractually have to, and below we will look at why this could be a game changer for you. It is important to note, however, that whether you are permitted to “overpay” depends on your individual agreement with the lender.

Understanding Personal Loan Repayment

A personal loan is a type of instalment loan where you receive a lump sum of money from a lender, which you then repay over time with interest. The amount of your monthly payment is typically fixed and agreed upon when you sign the credit agreement. However, that doesn’t always prevent you from adding to your monthly payment.

Benefits of Paying Extra

1. Reduction in Interest Costs

One of the primary benefits of paying extra on your personal loan is reducing the amount of interest you pay over the life of the loan. When you pay more than the minimum required each month, more of your payment goes towards the principal balance (the actual loan amount). This will then lower the amount of interest that accrues on the remaining balance, ultimately saving you money.

2. Faster Debt Repayment

By paying more than the minimum amount due each month, you can accelerate the repayment of your loan. This not only helps you become debt-free sooner but also reduces the overall financial burden of having the loan.

3. Improved Credit Score

Paying extra on your loan demonstrates financial responsibility and can positively impact your credit score. A higher credit score can lead to better loan terms and interest rates on future loans and credit cards.

4. Flexibility

Paying extra doesn't commit you to a higher monthly payment in the future. You can choose to pay extra only when you have the additional funds available, providing flexibility in managing your finances. Should you decide to make this move, there are a few ways you can navigate the process.

Should you decide to make this move, there are a few ways you can navigate the process.

- Increase Your Monthly Payment: Simply increase your monthly payment by any amount you can afford above the minimum required. If you work out a specific amount within your budget that you can commit to, this would be the easiest and most effective way to handle extra payments on your loan.

- Lump Sum Payments: Should you find yourself in a position where you have extra income at different points of the year, consider allocating a lump sum amount to pay towards your loan, this way you can impact your loan repayment significantly a few times a year. First, ensure that the credit provider allows this.

Applying for a Personal Loan with RCS

When you’re ready to apply for a personal loan, RCS offers several benefits that make us a reliable choice:

- Competitive Interest Rates: RCS offers competitive interest rates, ensuring you get a favourable deal based on your credit profile.

- Flexible Repayment Terms: You can choose a repayment plan that fits your budget (from 12 to 60 months), making it easier to manage your finances.

- Quick Approval Process: RCS provides fast approval times, ensuring you get the funds you need within 24 hours of your successful application.

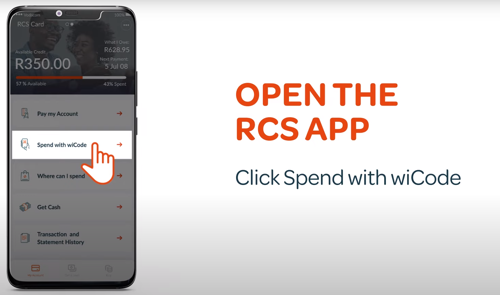

- Transparent Fees: RCS is transparent about any fees and charges associated with your loan, ensuring no surprises (track your account on the app).

Paying extra on your personal loan each month is a smart financial strategy that can save you money and help you become debt-free sooner. No matter how you opt to chip away at the loan total, whether it is monthly or in the form of lump sums - paying extra will pay off both on your current loan, and your ability to secure future credit.

Paying extra on your personal loan each month is a smart financial strategy that can save you money and help you become debt-free sooner. No matter how you opt to chip away at the loan total, whether it is monthly or in the form of lump sums - paying extra will pay off both on your current loan, and your ability to secure future credit.

To find out more about personal loans online from RCS, and how you can apply, visit the loans page on the official RCS website, and you could have cash in the bank in no time.