Why a Store Card Can Be Smarter Than Lay-By

09 OCTOBER 2025

When planning to buy something you can’t afford right now, two paths often emerge: lay-by or credit (such as an RCS Store Card).

Lay-by has long been a staple in South African retail, but products like the RCS Store Card now offer compelling benefits that, under the right conditions, can make them the smarter choice. This isn’t about promoting debt — it’s about making the most informed, responsible choice using the tools available.

Let’s explore how store cards can offer more flexibility, control, and even credit-building potential compared to lay-by.

What Is Lay-By

In South Africa, a lay-by is a purchase method where the retailer holds on to goods while the consumer pays in instalments until the full amount is settled. Only after full payment is the item delivered or made available to the buyer.

Some key features and advantages:

-

No interest or extra charges: The price you commit to is the price you’ll pay, with no interest component (though penalty fees for cancellation or missed payments may apply).

-

Consumer protections: Under the Consumer Protection Act (CPA), your payments remain your property until full payment, and suppliers must protect the goods until delivery.

-

Disciplined saving: Lay-by forces you to save toward the purchase rather than spend money you don’t yet have.

These features make lay-by appealing for planned purchases when you have time and wish to avoid interest. But it has limitations too.

Where Lay-By Falls Short

While lay-by avoids interest, it also has constraints:

-

Delayed ownership: You don’t get the item until the balance is fully paid, which can mean waiting months.

-

Locked price: Once you commit, you are stuck, removing the opportunity to take advantage of a better deal on the same item.

-

Cancellation risk and fees: If you cancel or cannot complete payments, you may forfeit amounts or face penalty charges (though capped under regulations).

-

Inflexibility in emergencies: Lay-by is poor for urgent needs — you cannot immediately access the goods or use the funds elsewhere.

So while lay-by is low-risk and simple, it can be limiting, especially when you need flexibility, speed, or more control.

What a Store Card Offers

A store card is a credit line linked to a specific store or group of stores. You can purchase now and pay later, subject to terms. Many South African retailers accept store cards, with the RCS Store Card allowing South Africans to shop at over 30 000 stores around the country.

Here’s how a store card can outperform lay-by when used wisely:

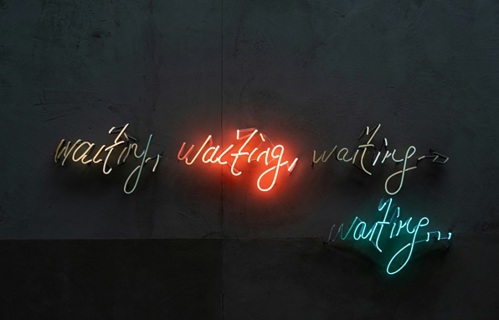

1. Immediate access to goods

Unlike lay-by, a store card lets you take home (or receive) the item immediately, paying it off over time. That solves the ‘waiting’ problem, which is especially valuable when the purchase is time-sensitive (e.g. school supplies, seasonal clothes, household essentials).

2. Interest-free credit periods

RCS offers up to 55 days of interest-free shopping (if you pay the balance in full by the due date). That means you can enjoy interest-free credit for a set window — similar to lay-by but with earlier access.

3. Flexibility in repayments

Store cards often allow structured payments beyond just paying the full statement. You might choose an instalment or budget plan (e.g. 24 or 36 months), spreading the cost without resorting to separate loans.

This flexibility gives you more control over your cash flow than lay-by’s rigid schedule.

4. Credit building benefits

Using a store card responsibly helps build your credit history. Store accounts, like other forms of credit, are typically reported to credit bureaus. Making timely payments, keeping balances manageable, and maintaining good conduct can strengthen your credit profile

This means that not only do you have immediate access to goods you purchase, but you are also potentially unlocking future credit options (loans, credit cards, etc.).

When Lay-By Still Makes Sense

There are contexts where lay-by remains a decent option:

-

No immediate need for the goods — you can plan well ahead.

-

You lack a credit history or can’t qualify for a store card. Lay-by requires no credit check, making it accessible to many

How to Use a Store Card Wisely

To make a store card work for you, you must use it with discipline:

-

Where possible, look to pay the full balance within the interest-free window.

-

Avoid carrying unnecessary balances — stick to what you know you can afford.

-

Understand your card’s terms: monthly fees, interest rates after grace period, and penalties.

Lay-by and store cards each have roles. Lay-by is simple, zero-interest, and safe — strong for planned purchases with time on your side. But when opportunity, timing, or flexibility matter, an RCS Store Card can be the ideal tool. You get early access, optional interest-free periods, credit-building potential, and the ability to spread costs without being shackled by rigid schedules.

The key lies not in the tool itself, but in how you use it.