Insurance

Innovative, affordable insurance solutions

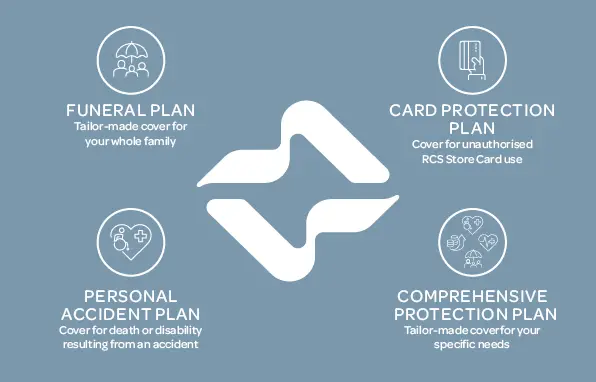

Insurance Products

-

-

Card Protection Plan

-

Funeral Plan

-

Personal Accident Plan

-

Comprehensive Protection Plan

-

Critical Illness Plan

-

Income Protection Plan

RCS offers affordable insurance solutions that can be tailor-made for your needs.

Premiums can be conveniently billed to your RCS store card.

Personal Accident Plan: Takes care of your loved ones if you pass away or become disabled as a result of an accident.

Funeral Plan: Flexible so you can cover yourself, your spouse, up to 5 dependent children and up to 6 extended family members.

Card Protection Plan: You don’t have to worry about unauthorized use on your RCS Store Card if you have taken out our Card Protection Plan. Cover for just R 15 per month.

Comprehensive Protection Plan: Gives you freedom of choice. Death cover and a choice between Severe Illness cover, Permanent Disability cover or an Income Booster with a daily monetary benefit for when you are in hospital.

RCS Insurance is underwritten by Guardrisk Life Limited, an authorized financial services provider (FSP76) and a licensed life insurer, and Guardrisk Insurance Company Limited, an authorized financial services provider (FSP75) and a licensed non-life insurer.

Have a Question?

Send an email to

policies@rcsgroup.co.za

Contact RCS on

0861 729 727 or 021 597 4000

Want To Know More?

Who is RCS?

RCS is a consumer finance business that offers financial services to suit your lifestyle needs – including cards, loans and insurance.

RCS is a registered Credit and authorised Financial Services Provider. NCRCP 38/ FSP 44481.

Insurance - What is Customer Protection Insurance?

For your protection we offer Customer Protection Insurance to take care of the debt obligation on your Store Card.

Benefits:

- Death – covers your outstanding store card account balance

- Permanent Disability - covers your outstanding store card account balance

- Loss of Income – covers up to 12 months’ store card account instalments

- Temporary Disability - covers up to 12 months’ store card account instalments

DISCLAIMER

Customer Protection Insurance is underwritten by Guardrisk Life Limited, an authorized financial services provider (FSP76) and a licensed life insurer, and administered by RCS Cards (Pty) Limited, an authorized financial services provider (FSP44481).

Please see our Terms and Conditions for more information

How do I apply for Customer Protection Insurance?

For your protection Customer Protection Insurance is offered where you have an approved store card and/or loan with RCS. You have the right to waive the Customer Protection Insurance offered by us and to substitute it with a policy of your own choice, which covers the same benefits and which policy must then be ceded to RCS with written directions as stated in the National Credit Act. Customer Protection Insurance is optional on all credit cards. For more information contact the insurance team on 0861 729 727, or policies@rcsgroup.co.za

DISCLAIMER

Customer Protection Insurance is underwritten by Guardrisk Life Limited, an authorized financial services provider (FSP76) and a licensed life insurer, and administered by RCS Cards (Pty) Limited, an authorized financial services provider (FSP44481).

If you have further queries, please contact RCS Insurance on 021 597 4000/0861 729 727 or email policies@rcsgroup.co.za.