Personal Loan vs Car Finance

11 AUGUST 2023

In this article, we examine personal loans and car loans in more detail to find whether auto financing or a loan offers better value for your money. Deciding how to finance your dream car can seem like a difficult choice. Making this choice requires careful consideration of how each credit option operates and how it may help you. Here, we examine personal loans and car loans in more detail.

Deciding how to finance your dream car can seem like a difficult choice. Making this choice requires careful consideration of how each credit option operates and how it may help you. Here, we examine personal loans and car loans in more detail.

Lenders have a significant advantage in the event that you don't repay a vehicle loan, therefore, banks mostly provide better rates for vehicle financing. Since they are the rightful owners of the vehicle, if you default on your payments, they will repossess the car and sell it to recover some of your debt. You get a better deal because the loan is less risky for them as a result. Banks dislike financing the purchase of older vehicles and typically won't finance vehicles that are ten years old or older. Finance agreements typically continue for six years, but since a car will be worth very little after some years, there is little purpose in seizing it. As a result, they frequently avoid selling used cars.

When the banks are a little uneasy about vehicle financing, they may require you to make a deposit on the vehicle as a condition of the credit agreement. Providers of personal loans won't be as strict, but they might charge you a higher interest rate. Securing a personal loan can be your best option if you're wanting to buy an affordable older model. If you can't afford the deposit, a personal loan might be helpful.

A personal loan can be a fairly effective method to buy a car, but this will primarily depend on your credit score and capacity to pay back the loan. You can choose an unsecured or secured loan when you take a loan. If you have an unsecured loan, you don't have any assets to use as collateral. Because the bank will lose money if you can't pay it back, you'll pay more in interest.

If you choose auto financing, the vehicle you are purchasing is used as collateral. A car loan should have a lower interest rate because it is seen as a lower risk, and it is also simpler to arrange financing for a car than a personal loan. But until you make that final payment—or worse, the balloon payment, if you chose that option—the car isn't truly yours! However, this could benefit your credit score, provided you always make the payments timeously.

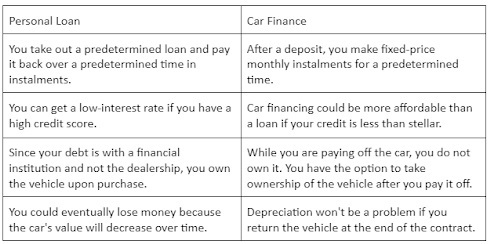

Pros and Cons?

Your credit score, your salary, and the kind of car you desire are just a few of the variables that determine which financing option is more affordable between a personal loan and a loan payment. A loan is probably less expensive than auto finance if you have strong credit and access to the cheapest rates. You should tally up all of the expenses to determine whether auto financing or a loan offers better value for your money. This includes any deposit you're required to make, the interest, and any possible costs. You can compare quotes to determine what rates and offers you qualify for, and then use this information to assist you in finding the most affordable choice.